Prime cost method depreciation formula

Assets cost x days held. The remaining depreciation claim of 521 for the diminishing value method or 212 from the prime cost method after fifteen years would be claimed over the balance of the life of the.

2

Prime cost refers to a manufactured products costs which are calculated to ensure the best profit margin for a company.

. If the cost of an asset is 50000 with an effective life of. The formula for calculating depreciation using the prime cost method is as follows. Consider a piece of equipment that costs.

This method returns higher depreciation deductions in the first few years of ownership of the property. View Depreciation Methodsdocx from BUSINESS 5912 at Academies Australasia College. The formula for prime cost depreciation method is assets cost x days held 365 x 100 assets effective life.

The prime cost calculates the use of raw. Under the prime cost method also known as the straight line method you depreciate a fixed amount each year based on the following formula. 21 Fixed Installment or Equal Installment or Original Cost or Straight line Method.

Depreciation is calculated using the formula given below. 2 Methods of Depreciation and How to Calculate Depreciation. Depreciation is calculated using the formula given below.

Prime cost straight line and diminishing value methods In most cases you can choose to. Straight Line Depreciation Method Cost of an Asset Residual. P r i m e C o s t R a w M a t e r i.

Depreciation 330000 in year 1 and 2. It uses low-value and low-cost pooling to increase the claim on. Lets discuss each one of them.

If the machines life expectancy is 20 years and its salvage value is 15000 in the straight-line depreciation method the depreciation expense is 4750 110000 15000. The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life. 22 Diminishing balance or Written down.

Depreciation Asset Cost Residual Value Life-Time. This depreciation method calculates the decrease in values of an asset over its effective life at a fixed rate per year using the following formula. The two components of prime cost formula are direct materials and direct labor.

The prime cost figure is also helpful in setting the price at such a level that can easily generate enough profit for the company. Depreciation Formula for the Straight Line Method. The prime cost to produce the table is 350 200 for the raw materials.

Assets cost days held365. The prime cost formula. For example the first-year.

Depreciation Expense Cost Salvage value Useful life. Unit of Production Method. The formula for prime cost depreciation method is assets cost x days held 365 x 100 assets effective life.

There are primarily 4 different formulas to calculate the depreciation amount. Opening un-deducted cost days owned 365 100 assets effective life in years A BMT Tax.

Periodic And Perpetual Inventory System Methods Examples Formulas

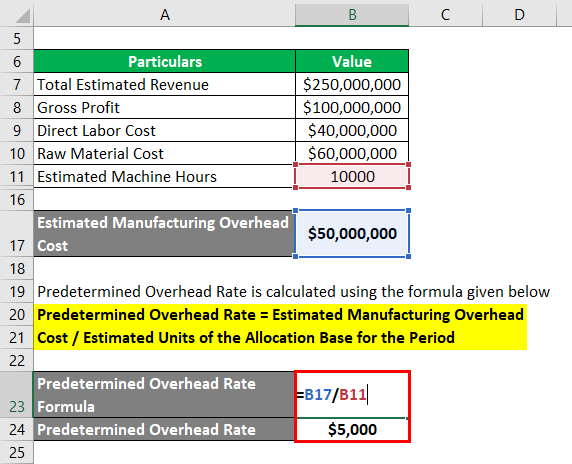

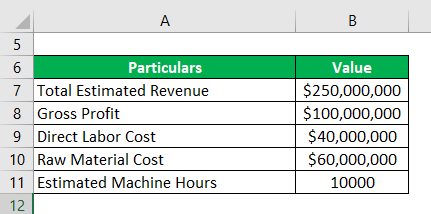

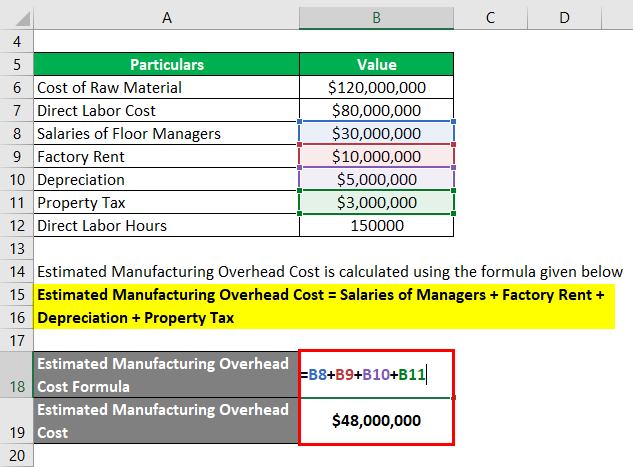

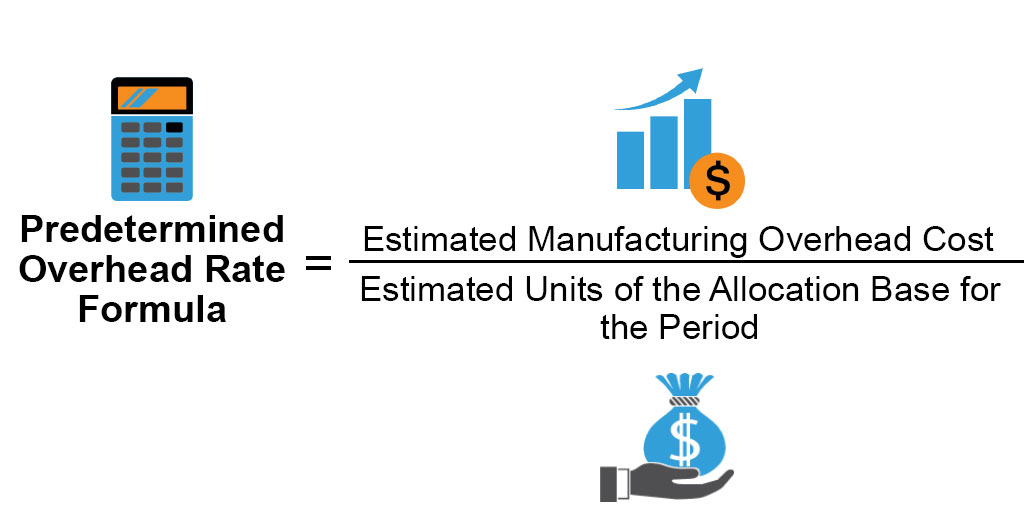

Predetermined Overhead Rate Formula Calculator With Excel Template

How To Read A Profit And Loss Statement For Restaurants Bars

Do You Diy Your Tax Return

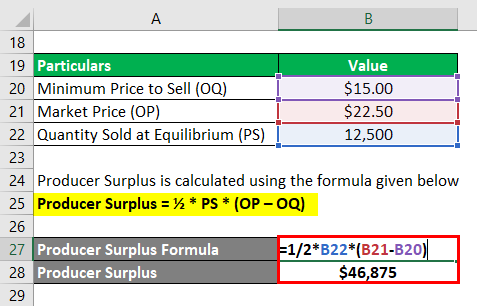

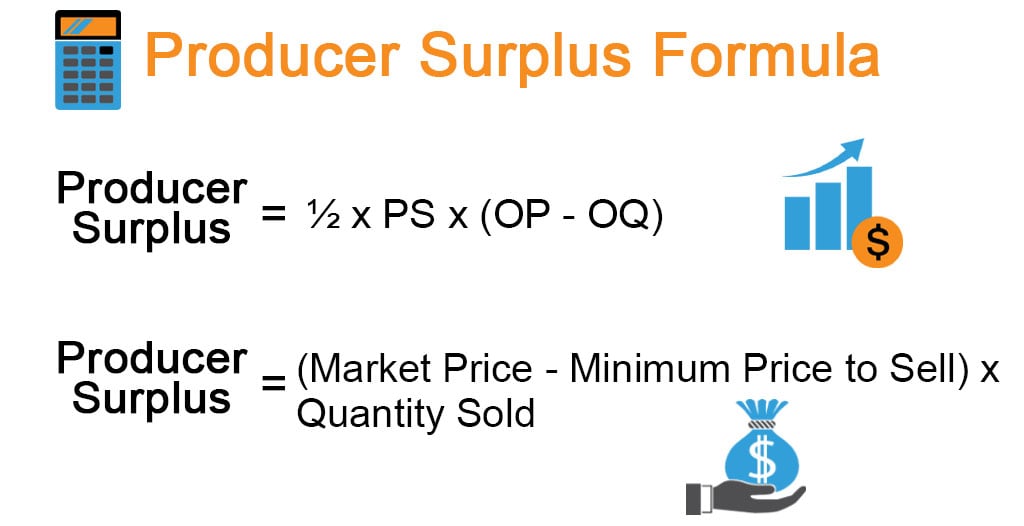

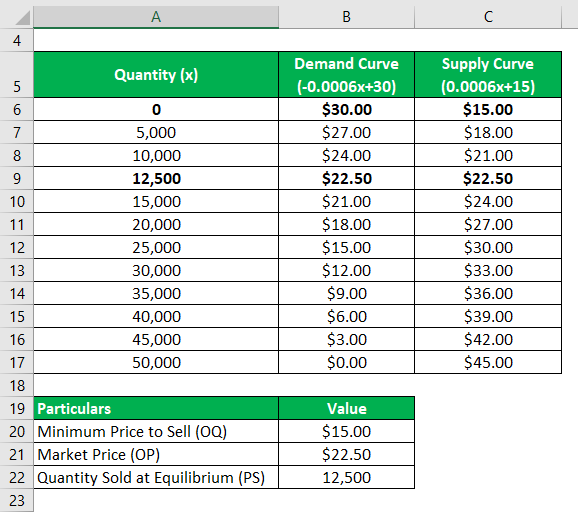

Producer Surplus Formula Calculator Examples With Excel Template

Depreciation And Capital Expenses And Allowances

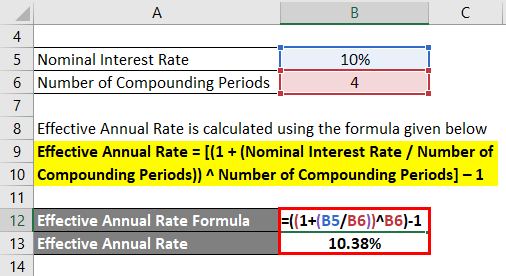

Effective Annual Rate Formula Calculator Examples Excel Template

Predetermined Overhead Rate Formula Calculator With Excel Template

Predetermined Overhead Rate Formula Calculator With Excel Template

/dotdash-INV-final-Absorption-Costing-May-2021-01-bcb4092dc6044f51b926837f0a9086a6.jpg)

Absorption Costing Definition

Producer Surplus Formula Calculator Examples With Excel Template

Prime Cost Importance Of Prime Cost Advantages And Disadvantages

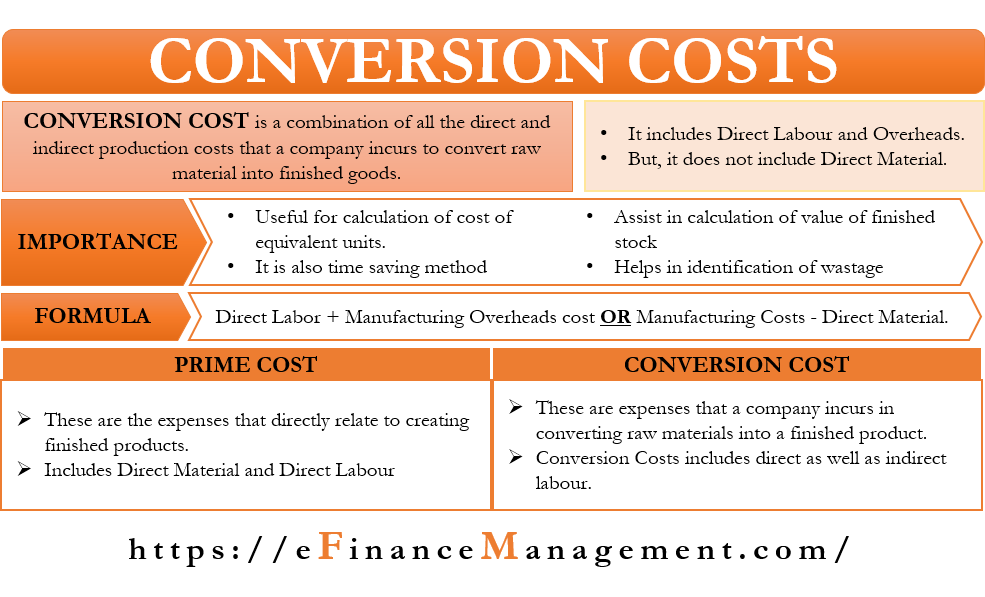

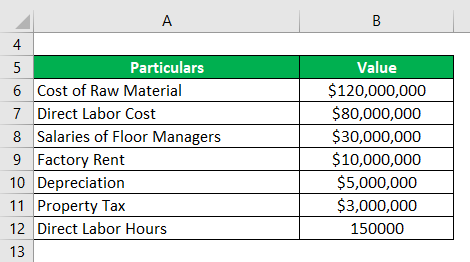

Conversion Cost Meaning Importance Formula And More

Predetermined Overhead Rate Formula Calculator With Excel Template

Producer Surplus Formula Calculator Examples With Excel Template

Predetermined Overhead Rate Formula Calculator With Excel Template

Effective Annual Rate Formula Calculator Examples Excel Template